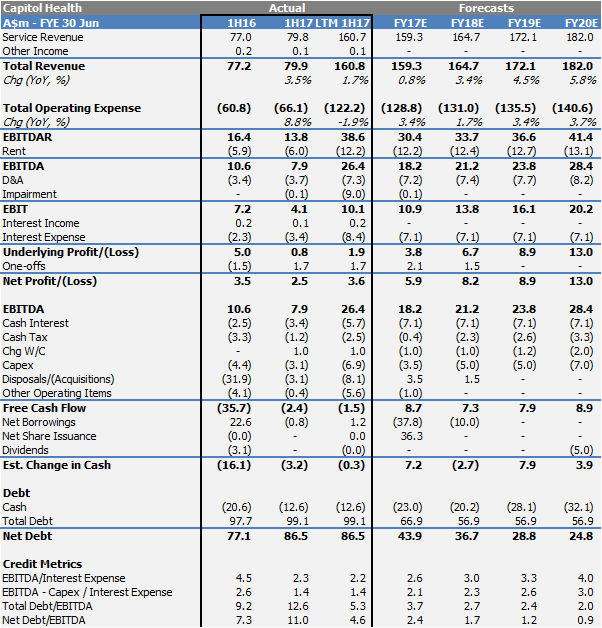

While 1H17 results were weak, industry dynamics are steadily improving. During April, Capitol raised $38.5m in equity for debt reduction. Capitol’s net debt position has improved significantly and the company is targeting further deleverage.

Summary financials

Source: FIIG Securities, Company reports

Source: FIIG Securities, Company reports

- Revenue increased 3.5% over the corresponding period to $79.9m, of which $1.98m was due to businesses acquired in 2015 that were not part of the group for the full prior period. There were no changes in the level of Medicare rebates however Medicare diagnostic receipts continued a growth trend

- While EBITDA was down, radiology EBITDA prior to significant items was $9.3m which compared favourably to the AGM guidance of $7.9m

- Significant revenue items included a profit on property sale of $0.2m (2015: $0) and write back of deferred consideration on acquisition of $1.5m (2015: $0). Significant expense items were restructuring costs of $0.5m (2015: $0.2m), loss on unamortised share options granted in prior year and forfeited in the current period of $0.5m (2015: $0) and a recognition of an impairment loss in the investment in the listed entity Mach 7 Technologies Limited of $0.1m (2015: $0)

- Borrowing expense increased by $1.06m (45%) over the corresponding period in the prior financial year primarily due to the higher cost of the Senior Unsecured Notes. However this will reduce with the capital raise and asset sales

- Capitol reiterated its FY17 guidance of revenue of $162-165m and ‘core’ EBITDA of $19.5-21.5m

$38.5m equity raise

During April, Capitol raised $35m from an institutional private placement and a further $3.5m via a share purchase plan. Net proceeds were used to repay debt. Capitol states that as of 18 April 2017, net debt was $44m ($86.5m HY16) and net debt/EBITDA was 2.16x (4.6x HY16).

Capitol is targeting net debt/EBITDA of below 2.0x in FY18 from asset sales, free cashflow generation and improved earnings.

Industry dynamics

Industry dynamics are steadily improving with Medicare growth rates at 4%. Capitol advises that with the appointment of the new health minister, discussions with the industry have improved. Management believe bulk billing cuts seem unlikely. Further, the government is entertaining introducing indexation (there has been no price increases in the DI industry for 15 years). This would be a strong positive for the company.

Market outlook

Source: Capitol Health